Senate Republicans Reverse Overdraft Fee Cap, Sparking Debate

On March 27, a decision by Senate Republicans led to the repeal of a Consumer Financial Protection Bureau (CFPB) rule that limited most bank overdraft fees to $5.

Overdraft fees are incurred when account holders spend beyond their available balance. These charges can accumulate interest, potentially exacerbating financial difficulties for those already struggling.

Initially implemented in December 2024, the rule aimed to alleviate financial burdens on Americans, with the CFPB projecting household savings of up to $225 annually, potentially saving billions overall.

Of the Senate Republicans, only Missouri Sen. Josh Hawley opposed the repeal.

This vote marks the second instance within a month where Republicans have moved to dismantle a CFPB regulation. Earlier, on March 5, they repealed a regulation mandating that electronic payment apps like Zelle and Venmo adhere to the same regulations as major banks, aiming to bolster fraud prevention and prohibit service denial based on political views.

The Republican-controlled House of Representatives will now determine the future of these regulations.

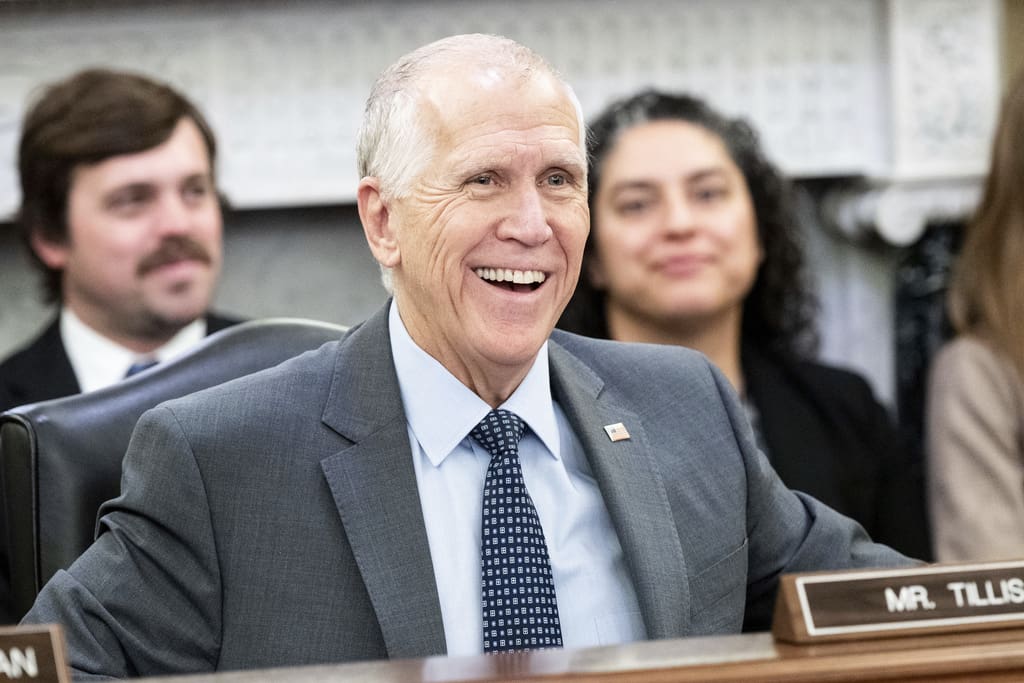

The repeal initiative was backed by 12 co-sponsors, including North Carolina Sen. Thom Tillis, a key target for reelection in 2026.

Critics, such as Lauren Saunders, associate director of the National Consumer Law Center, have expressed concern, stating, “It is shameful that Republicans are effectively writing bonus checks to executives at the nation’s largest banks while ordinary people struggle with high prices and increased costs of living.”

No comment was received from a spokesperson for Tillis regarding the decision.

For more details, see the original article: Senate Republicans vote to eliminate cap on overdraft fees on American Journal News.

—

Read More Kitchen Table News