CFPB Layoffs Begin Amidst Strategic Shift Under Trump Administration

In a significant organizational shake-up, the Consumer Financial Protection Bureau (CFPB) has commenced issuing layoff notices to its employees, marking a new phase in the Trump Administration’s ongoing efforts to curtail the agency’s operations.

The reduction-in-force actions, described in notices obtained by NPR, aim to “restructure the Bureau’s operations to better reflect the agency’s priorities and mission.” This follows a recent court ruling by a federal appeals panel that enabled the CFPB’s leadership to proceed with layoffs of personnel deemed non-essential for fulfilling the agency’s statutory duties.

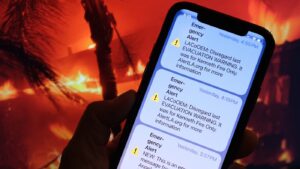

Layoff notices were dispatched to the staff on Thursday afternoon, but the exact number of employees affected remains undisclosed. This move comes after a three-judge panel ruled in favor of the agency’s ability to issue these notices, while maintaining a separate injunction preventing the CFPB from being dismantled, ensuring the protection of data, and stipulating that employees retain workspace or remote work capabilities.

Shifting Focus and Controversy

On the eve of the layoffs, CFPB’s chief legal officer Mark Paoletta circulated a memo outlining a redefined strategic focus for the bureau. As per the memo reviewed by NPR, the CFPB intends to rely more heavily on state-level enforcement and supervision activities. This approach is anticipated to enable the agency to concentrate on addressing direct consumer harms.

Paoletta’s memo further indicates a shift in focus back to banks and depository institutions, such as credit unions and commercial banks, while “deprioritizing” areas like medical debt, peer-to-peer platforms, and digital payments. This latter point is particularly noteworthy given that tech mogul Elon Musk, who has been vocal in his criticism of the CFPB, is developing a digital payments platform potentially subject to CFPB’s oversight.

Founded after the 2008 financial crisis, the CFPB has faced criticism from the Trump administration, Silicon Valley, and Wall Street, who argue that its regulatory reach is excessive. Consumer advocacy groups, however, have voiced concerns over the agency’s new direction, suggesting it represents a retreat from its foundational consumer protection mission.

Lauren Saunders, associate director of the National Consumer Law Center, remarked, “The CFPB cannot simply shirk the consumer protection responsibilities Congress gave it and expect states to enforce federal law.”