The Resumption of Student Loan Collections: What Borrowers Need to Know

As the Department of Education gears up to resume collections on defaulted student loans, many borrowers are bracing themselves for the financial impact. The decision, which will affect millions nationwide, marks the end of a five-year hiatus on collections.

Beginning May 5, the Department of Education’s office of Federal Student Aid will restart the collection process for defaulted student loans. This means funds could be deducted from borrowers’ tax refunds and Social Security benefits, with wage garnishments soon to follow. “Together, these actions will move the federal student loan portfolio back into repayment, which benefits borrowers and taxpayers alike,” stated Education Secretary Linda McMahon.

The change will impact approximately 5.3 million borrowers who defaulted before the pandemic. A loan is officially in default when no payments have been made for at least 270 days. In addition, 2.9 million borrowers are currently 61-90 days late on payments, while another 4 million are nearing default status.

Scott Buchanan, executive director of the Student Loan Servicing Alliance, commented, “Most borrowers … they’re not in danger of delinquency today, but in five months, they could be. And so taking action today is pretty important.”

The Education Department plans to issue wage garnishment notices later this summer, while also encouraging borrowers to make monthly payments or enroll in income-driven repayment plans.

Why Are Collections Restarting?

When the pandemic hit, nearly 8 million federal student loan borrowers were already in default. The Trump administration initially paused collections in March 2020, a measure that was extended by the Biden administration until October 2023. Now, the Department of Education aims to restore collections to their pre-pandemic status.

Betsy Mayotte, president of the Institute of Student Loan Advisors (TISLA), explained, “They were always going to start collecting these defaulted loans again — it was just a matter of when the switch was going to get flipped.”

How Can I Tell If I’m Impacted?

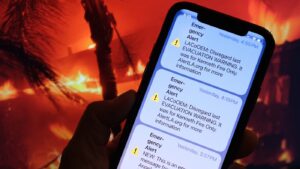

The Department of Education will notify all borrowers in default prior to May 5. Borrowers can also verify their status by logging into StudentAid.gov, which provides details about their loans and repayment status.

If you’re receiving bills from a loan servicer, it indicates that you’re not in default. According to Mike Pierce of the Student Borrower Protection Center, loan servicers will also reach out to those at risk of default through various communication channels.

What Are My Options If I’m in Default?

Borrowers in default have three primary options to regain good standing: full repayment, loan consolidation, or rehabilitation. “If people could pay the loan in full, they probably wouldn’t be in default,” Mayotte noted. Therefore, consolidation and rehabilitation are more viable solutions for most borrowers.

Loan consolidation involves paying off defaulted loans with new terms, while rehabilitation requires making a series of consecutive, on-time payments based on income.

What Resources Are Available?

With the Department of Education undergoing significant staff reductions, borrowers may face challenges in accessing support. However, alternative resources, including state ombudsmen and nonprofit organizations, are available to assist borrowers.

Buchanan advises borrowers to use the loan calculator on the federal student aid website to explore repayment options. “I think the most important thing for people to realize … is that the federal student loan program is probably one of the most flexible programs that exists when you borrow money,” Buchanan emphasized.

NPR’s Cory Turner contributed reporting.